Maximum 403b Contribution 2025 Over 55. If you're 50 or older, you can contribute an. This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403 (b) plan for 2025.

The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025.

2025 Simple Ira Contribution Limits For Over 50 Beth Marisa, There is an exception for employees over the age of. If you are age 50 or older in.

Simple Plan Contribution Limits 2025 Over 50 Rosie Zorina, If you're over 50, you. The annual 403 (b) contribution limit for 2025 has changed from 2025.

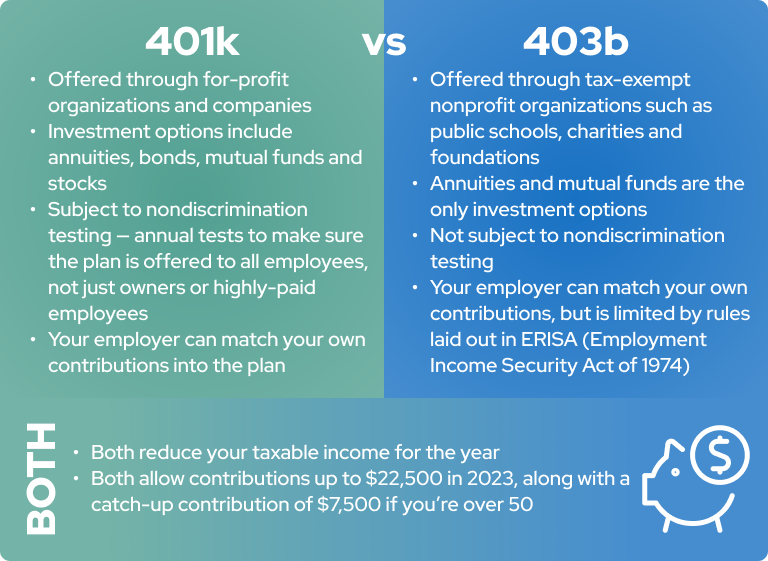

Optimize Your Retirement Max 403(b) Contributions 2025 Tips, The 403 (b) contribution limit refers to the maximum amount that an individual can contribute annually to their 403 (b) retirement savings plan. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new.

403(b) Retirement Plans TaxSheltered Annuity Plans, If you exceed this contribution limit, the irs will tax your funds twice. If you are age 50 or older in.

403(b) TaxSheltered Annuity Calculator, Contribution, Withdrawal Rules, The 403b contribution limits for 2025 are: The 401k/403b/457/tsp contribution limit is $22,500 in 2025.

403b Calculator Calculate Your Retirement Savings (2025), On your end, you can defer up to $23,000 from your salary to your 403 (b) in 2025. Employer matches don’t count toward this limit and can be quite generous.

403(b) Contribution Limits for 2025, 403 (b) max contribution is flexible. It will go up by $500 to $23,000 in 2025.

The Power Of 403(b) Plans Building A Secure Retirement, If you're 50 or older, you can contribute an. 403 (b) contribution limits in 2025.

Roth IRA 401k 403b Retirement contribution and limits 2025, Employer matches don’t count toward this limit and can be quite generous. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new.

2025 Contribution Limits Announced by the IRS, If you're over 50, you. The maximum 403 (b) contribution refers to the highest amount that an individual can contribute to their 403 (b) retirement plan in a given tax year.