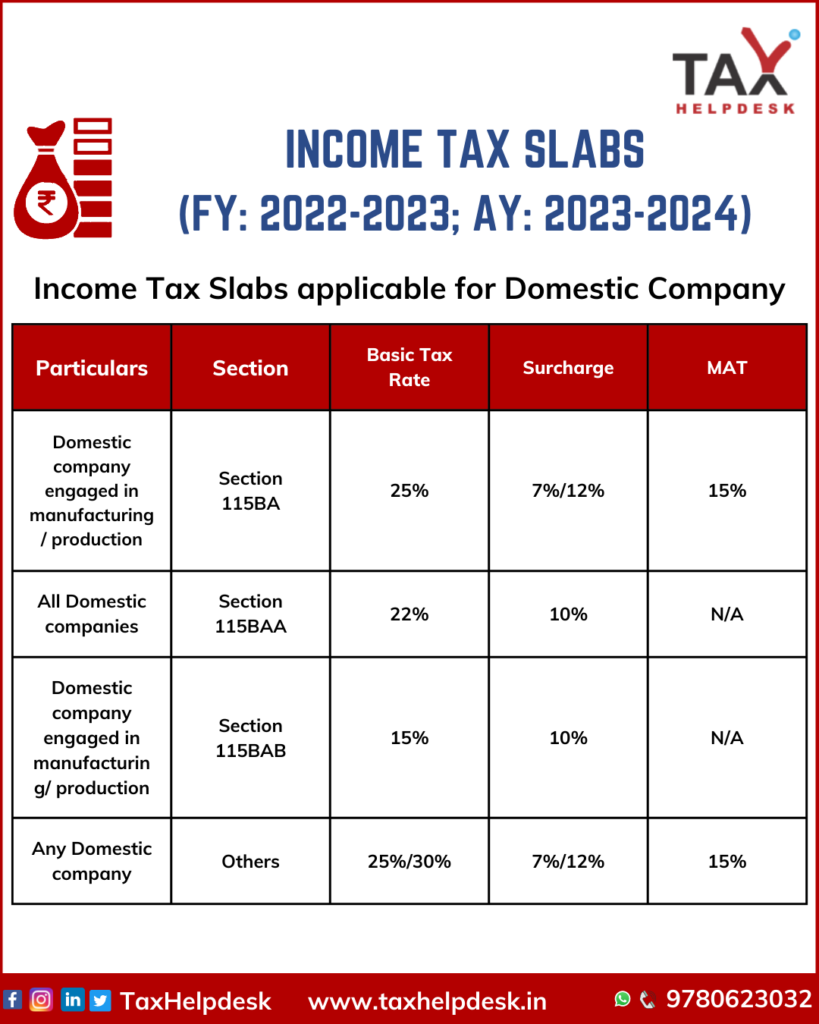

Income Tax For Companies 2025 Notification. Income tax rates for domestic company. Ministry of micro, small & medium enterprises (m/o msme) envision a vibrant msme sector by promoting growth and development of the msme sector, including khadi, village and coir.

Sc favours tax department in case that will impact fate of 90,000 income tax notices; For the purposes of this section specified person means a person who has not filed the returns of income for both of the two assessment years relevant to the two previous.

Tax Slab For Ay 2025 25 For Companies Image to u, 6 income tax rules introduced in budget 2025 to be effective from oct 1.

Tax Slab For Ay 2025 25 For Companies Image to u, The stt applicable to futures and options (f&o) trading is set to increase from october 1,.

HOW TO CALCULATE TAX ON BUSINESS 2025 Business Tax, The stt applicable to futures and options (f&o) trading is set to increase from october 1,.

Tax rates for the 2025 year of assessment Just One Lap, The stt applicable to futures and options (f&o) trading is set to increase from october 1,.

Tax Standard Deduction For Ay 202425 Calendar Jobi Ronnie, Highlights include revised tax slabs, increased deductions, and simplified taxation.

tax notice is an official communication from the tax, Revision in income tax rates for companies:

State Corporate Tax Rates and Brackets, 2025 Taxes Alert, As per section 2 (22a), domestic company means an indian company, or any other company which, in respect of its income liable to tax under this act, has made the prescribed arrangements for the declaration and payment, within india, of the dividends (including dividends on.

Tax Department Recruitment 2025 Notification for 291 Posts, Highlights include revised tax slabs, increased deductions, and simplified taxation.

Understanding The Singapore Tax Notice Of Asse vrogue.co, For details please refer notification no.

Notification On Annual Tax Returns Filing For Tax Year 2025, Ministry of micro, small & medium enterprises (m/o msme) envision a vibrant msme sector by promoting growth and development of the msme sector, including khadi, village and coir.